How To fill out a Sales & Use Tax Return

Learning how to fill out a Sales & Use Tax Return can be a challenge for a handmade or creative business owner, well actually any sort of business owner.

The second quarter just ended on June 30, so that means here in the U.S. many business owners need to complete and submit a Sales (& Use) Tax Return.

NOTE: Depending on the state you live in and the type of business you have will depend on how often you have to complete a Sales & Use Tax Return and what information you’ll need. Every state is different.

How often do I need to fill out a Sales & Use Tax Return?

When you sign up for your State Sales Tax ID, you’ll be asked a series of questions about your business. Then the Tax Department will decide when you have to complete and submit the tax return and the send them the Sales Tax you’ve collected, it could be:

- monthly

- quarterly

- semi-annually

- yearly

You’re always given roughly a month to complete the Sales Tax return (this too varies by state), so if you have to file:

- Monthly – the form is due the following month (you’d file your return for January in February)

- Quarterly – the form is due in April, July, October, and January

- Semi-Annually – the form is due in July and January

- Yearly – the form is due in January

What information do I need to complete a Sales & Use Tax Return?

Every State requires different information, so I can’t go into detail about what information you personally have to submit, but I can give you a general idea.

- Total Sales – this is the total amount that you made from the sale of whatever product or service you sell and/or provide. This amount does not include money you received from affiliate programs.

- Non-Taxable Sales – this is the total amount of money that you made from whatever product or service you sell and/or provide that is NOT subject to sales tax.

- Use Tax Due – Use tax has pretty much become a thing of the past, since just about every business is required to charge sales tax to all their customers

- Local Options, City or County tax you owe

Here’s an example of how to fill out a Sales & Use Tax Return

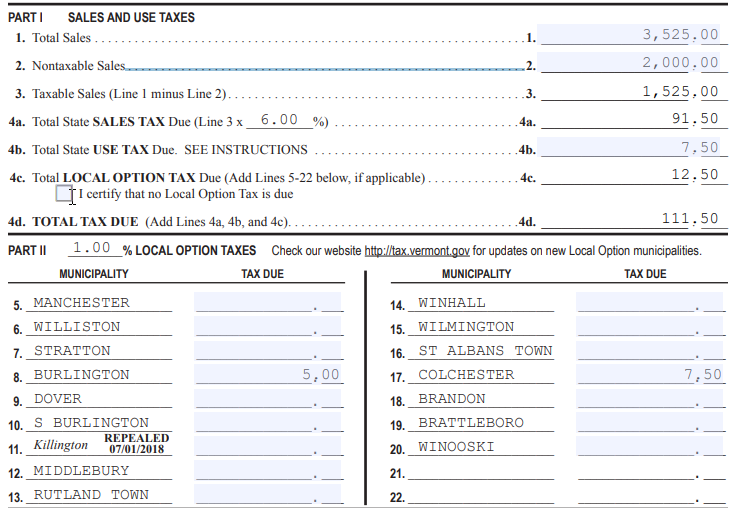

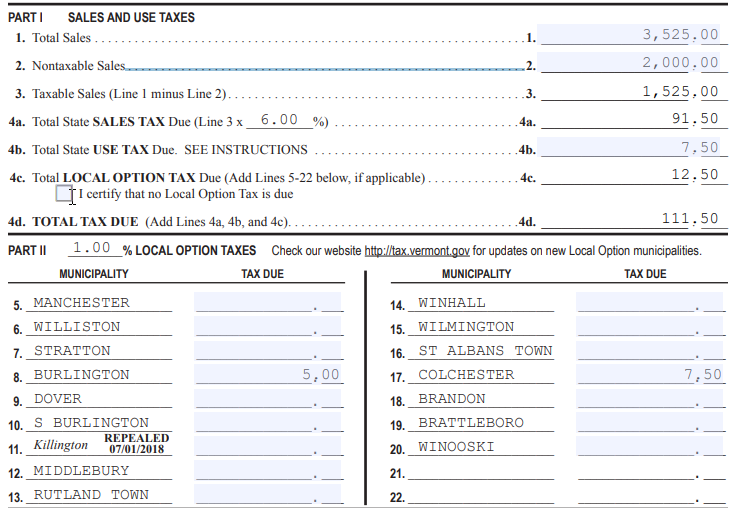

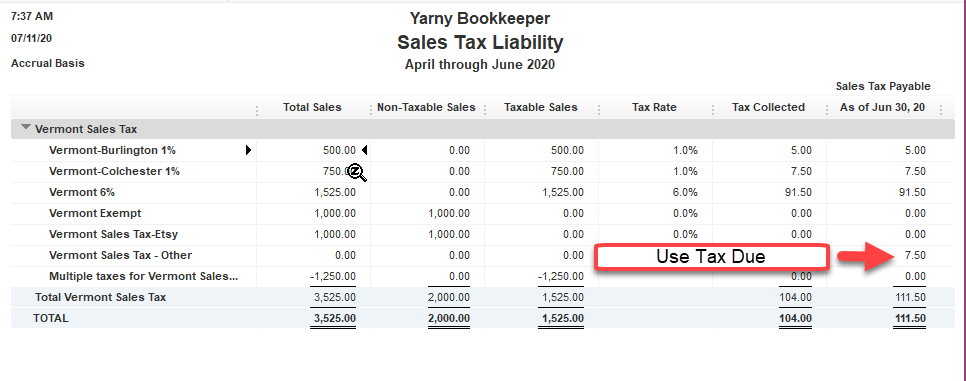

First, here’s my sales information:

- Total Sales for April, May & June – $3,525.00

- Sales of Non-Taxable Items (in my home State) – $1,000.00

- Etsy Sales (where sales tax was charged, collected & remitted) – $1,000.00

- Burlington Sales (subject to a 1% local option tax in addition to the regular 6% sales tax) – $500.00

- Colchester Sales (subject to a 1% local option tax in addition to the regular 6% sales tax) – $750.00

- Purchases made in New Hampshire (where there is NO Sales Tax & therefore I need to pay Use Tax) – $125.00

Here’s the math involved:

- $1,000.00 + $1,000.00 = $2,000.00 Nontaxable Sales

- $3,525.00 MINUS $2,000.00 = $1,525.00 Taxable Sales

- $1,525.00 x 6% = $91.50 Sales Tax on Taxable Sales

- $500.00 x 1% = $5.00 Burlington 1% Local Options Tax

- $750.00 x 1% = $7.50 Colchester 1% Local Options Tax

- $5.00 + $7.50 = $12.50 Total Local Options Tax

- $125.00 x 6% = $7.50 Use Tax Due on New Hampshire purchases

- $91.50 + $5.00 + $7.50 + $7.50 = $111.50 Total Tax Due

And, here is what my completed Sales & Use Tax Return would look like:

How on earth do I keep track of all this information?

Honestly, you need to have a good bookkeeping system in place.

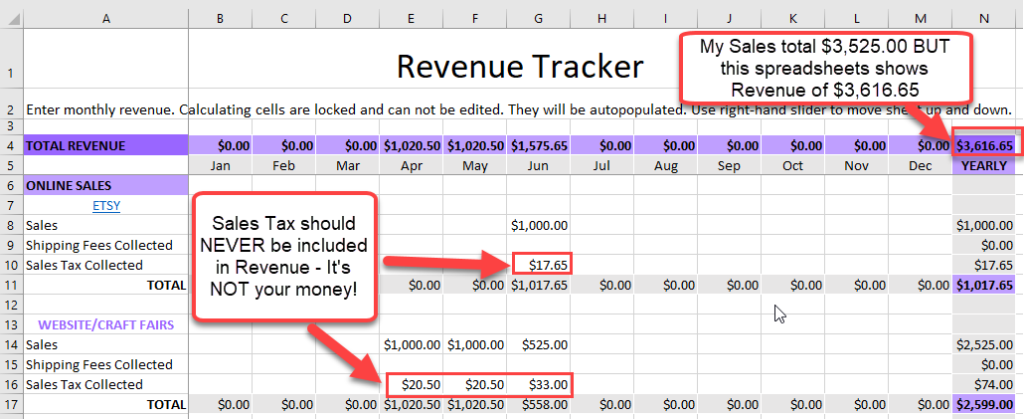

Spreadsheets are just going to be a mess! And many spreadsheets are just wrong!

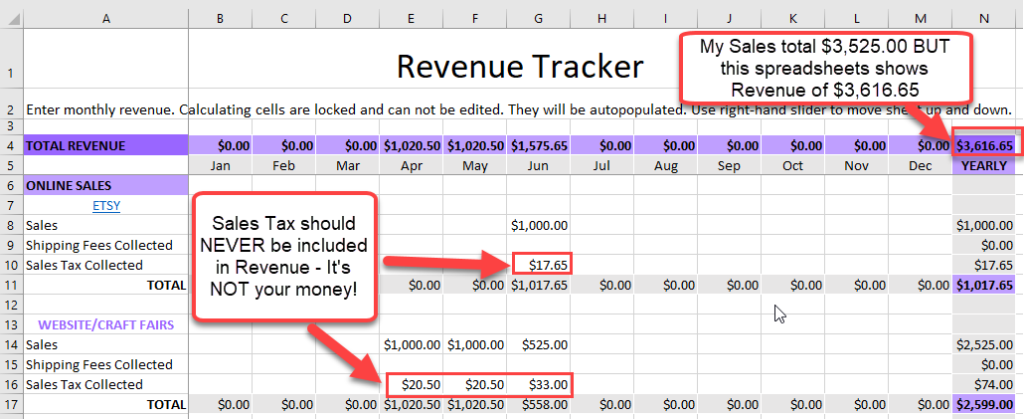

Here’s a screenshot of a popular Revenue Tracker spreadsheet many handmade and creative business owners use.

Here’s just two of things that are wrong with this Revenue Tracker spreadsheet:

- The Sales Tax that you collect SHOULD NEVER BE INCLUDED IN YOUR REVENUE! It’s not your money/income/revenue whatever you want to call it. Unfortunately, that’s exactly what this spreadsheet does. Remember my total sales were $3,525.00 – well this spreadsheet says that my Revenue is $3,616.65, because the person who designed the spreadsheet included the Sales Tax I collected as my Revenue!

- While I can enter my total sales, there is no way to separate (for sales tax tracking purposes) what were taxable and non-taxable sales. (There is no additional spreadsheet that’s included that allows you to separate Taxable vs. Nontaxable sales, so you’d need to design one or do a LOT of additional math).

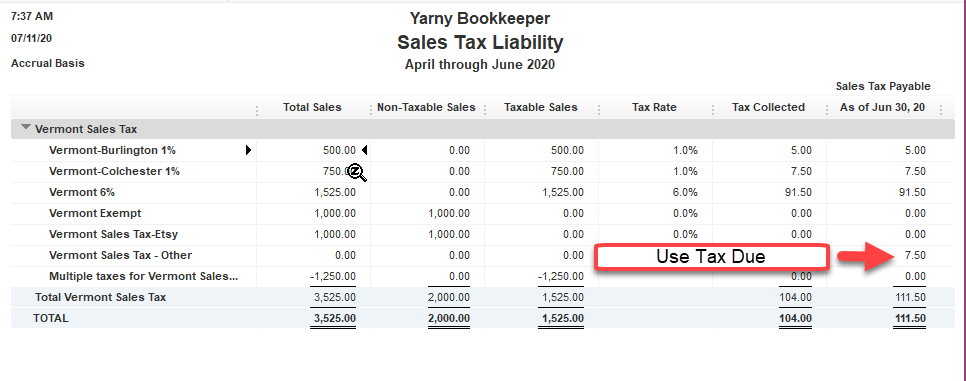

Having software, where you can set up different Sales Tax Rates (including 0% rates for different Nontaxable Sales items) is definitely the way to go.

Here’s my Sales Tax Liability Report from QuickBooks.

When you utilize a software program, such as QuickBooks, all you have to do is make an adjustment for the Use Tax that is owed, run your Sales Tax Liability Report and complete your Sales & Use Tax Return using the information from the report.

This is why I prefer software over spreadsheets for your bookkeeping needs.

Note:

When completing the Sales Tax Return for your home state, sales that you make:

- to customers in other states OR

- sales that you made through Etsy or another platform where sales tax was charged & collected

would fall under the Non-Taxable Sales category in your home state.

About Nancy Smyth, The YarnyBookkeeper

Hi, I'm Nancy. Yarn addict, career bookkeeper, and handmade business owner. I get the same feeling of joy when working with yummy yarns as I do when working with a column of numbers that all add up correctly. Bookkeeping for your handmade or creative business doesn't need to be scary. I can help you learn to handle your bookkeeping and other behind the scenes STUFF with confidence!